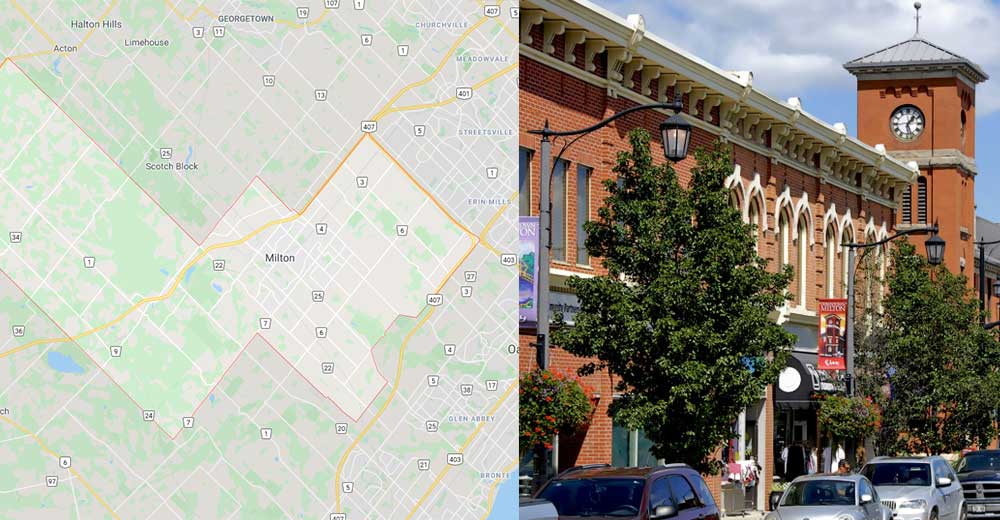

If you’ve been denied long term disability benefits our Milton disability lawyers can help. Matt Lalande has been litigating disability cases for claimants province-wide since 2003. We understand that being denied long-term disability benefits can send a claimant and his or her family rocketing into debt – and put into an aggravating position that causes financial distress. if you or a family member has had your disability benefits denied call us today. Our Milton disability lawyers have represented disability claimants against every major disability insurance company throughout Ontario. You have the right to appeal your denied benefits with the help of a qualified Milton Disability Lawyer. We are able to help all claimants get their short or long term disability benefits back on track. Since 2003, our disability law firm has represented Milton disability claimants against every major Canadian disability insurance company. We have earned our reputation in both Milton and throughout Ontario as client-focused disability insurance trial lawyers.

Typically disability policies are purchased by an individual or be part of a group employment package that is negotiated between employer and broker. Premiums are paid in one of three ways, by the policyholder individually, the employer solely or the employer and employee. Normally, an employee will apply for short-term disability through their group insurance company or directly through their employer. Sometimes when benefits are employer paid, the benefits are managed and administrated by a long-term diability carrier. In other occasions, smaller employers do not have a short-term disability policy and the employee must apply for sick benfits throught EI – and after the end of the sick leave benefits, they may be entitled to apply for long-term diability benefits to their insurance carrier. The situations depends on the employer-benefit carrier employment relationship.

There is usually a qualifying or elimination period, which can range from 90 to 180 days, during which no benefits are paid but the person may cover their lost wages by drawing on an STD policy, EI or government sickness benefits, which may provide an additional 15 weeks of sick benefits. STD policies are sometimes paid for by your employer and cover income replacement for the first 120 days of injury or illness.

A long-term disability policy generally pays a portion of your usual salary or income as a monthly benefit until you:

Some policies only pay for a defined period (such as 5, 10 or 15 years). Other policies cover the person for life.

In order to qualify for long-term disability benefits you must satisfy the definition of “total disability” as set out in your long-term disability policy.

The definition of “total disability” varies from policy to policy and impacts the level of coverage available. Typically, the definition of total disability differs between pre and post 24 months of disability.

For the first 24 months, the definition of total disability generally means that you are unable to work or, more specifically, unable to carry out the substantial duties f the individual’s usual job.

After 24 months there is typically a “Change of Definition” – meaning the test for total disability changes from your own occupation to any occupation. This change of definition requires you to be disabled from performing any occupation for which you are reasonably suited by reason of education, training or experience.

There are a variety of reasons why an LTD claim may be denied or terminated:

Sometimes you can resolve the LTD claim for a reasonable amount without resorting to litigation – and we try out best to do this.

Typically, when a claim is denied, most policies provide for a right of appeal by submitting a written request for appeal within a certain amount of time, usually within 60 days. The insurer will then review the appeal and provide a decision by letter. If this decision fails, then you may commence an action against your LTD insurer for payment of past benefits and seek a declaration form a Judge that you are disabled and that your disability benefits should be reinstated.

If you live in Milton and you are an employee that cannot work because of your disability, call us today at 905-333-8888. We have been litigating disability claims since 2003. We retain the appropriate doctors, specialist, vocational specialists, psychiatrists, economists and any other professional required to discharge your burden of proving your total disability. Alternatively, you can contact us by filling in a contact form or by chatting with out live chat agent 24/7. It is absolutely essential that you retain a disability insurance law firm that has the experience to effectively represent you, as a disability insurance claimant, against your disability insurance company.